Stop wasting weeks hunting for DePIN investors. Get 150+ verified VCs, crypto funds, corporate VCs, and angels backing Decentralized Physical Infrastructure and related sub-verticals. Includes decision-maker names, direct outreach paths (Twitter/X, LinkedIn, and emails where publicly available), plus notable DePIN bets and source URLs to validate fit.

- ✅ 150+ active DePIN investors across AI-Infra, RWA, Utility & Multi-vertical categories

- ✅ Direct contacts: Twitter handles, LinkedIn profiles, emails where publicly available

- ✅ Key decision-makers identified: Partners, MDs, investment leads, etc. – not generic info@ emails

- ✅ Portfolio intelligence included: See which DePIN projects they’ve actually funded (Helium, io.net, DIMO, Render, Hivemapper & more)

- ✅ Verified Dec 2025: Fresh contacts from this year’s funding rounds, with source URLs to validate thesis fit

- ✅ Best for: Pre-seed/Seed founders building DePIN (compute/GPU, connectivity, IoT, data networks, mapping, mobility, energy, sensors)

Format: Google Spreadsheet (instant access)

Updated: December 2025

Price: €149 one-time

Why founders buy this

- Faster targeting: DePIN-only focus → less irrelevant outreach.

- Fundraising Outreach-ready: direct links to decision-makers (and email where available).

- Cleaner personalization: sub-vertical tags + notable bets help you craft relevant messages.

- Execution-friendly: filter/sort and start your outreach workflow immediately.

What’s inside this DePIN Investor Database

Every entry gives you what you need to start cold outreach today, no additional research required.

Database Columns:

1. Investor Profile

- Full investor name (fund, syndicate, angel, corporate VC, ecosystem fund)

- Investor type: Crypto VC Fund, Angel, Corporate VC, Family Office, Ecosystem Fund, Accelerator

- DePIN sub-vertical focus: AI-Infra DePIN, Utility DePIN, RWA-aligned DePIN, Multi-vertical and more..

- Website and official social profiles

2. Decision-Maker Contacts

- Key person name + title (Partners, Managing Partners, Investment Directors)

- Direct outreach contacts: Twitter/X handles, LinkedIn profiles

- Email addresses (where publicly available)

- No generic “info@” emails – actual decision-makers only

3. Portfolio Context

- Notable DePIN investments: Helium, io.net, Render, DIMO, Hivemapper, Filecoin, WeatherXM, Theta, Akash, and 100+ more projects

- Investment stages (Pre-seed, Seed, Series A, Growth)

- Verified sources: URLs to funding announcements, portfolio pages, press coverage

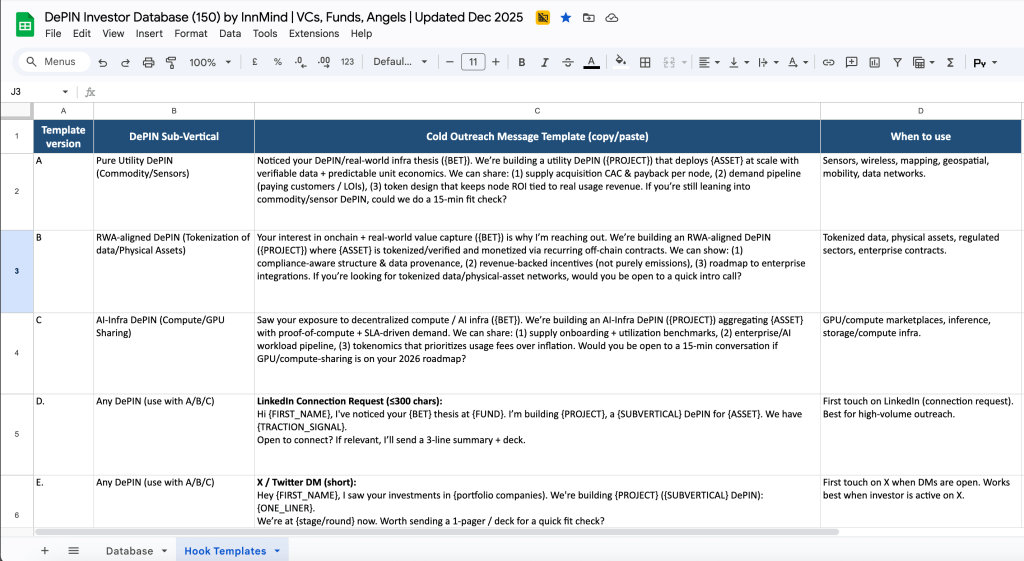

Bonus Tab: ready-to-use messages drafts for personalizing DePIN-focused cold outreach

Partial Investor List (sample):

Borderless Capital, Multicoin Capital, Dragonfly, 1kx, Hack VC, Pantera Capital, Variant, CoinFund, Coinbase Ventures, Samsung Next, Framework Ventures, Polychain Capital, a16z crypto, Electric Capital, Protocol Labs, Solana Ventures, and 130+ more.

Why this beats generic “free” investor lists

Free lists usually fail in the same places:

- too broad (Web3 in general, not DePIN),

- unclear relevance,

- missing key people,

- no usable contact paths,

- no sourcing & outdated data.

This DePIN investor database is built for action:

- DePIN-only focus

- Key person + direct outreach link on every row (email where available)

- Sub-vertical tags to personalize and improve relevance

- Sources to validate fit and reference investor bets

Who’s in the DePIN Investor Database

By Investor Type:

- Crypto VC Funds: 45+ funds (Multicoin Capital, Dragonfly, Hack VC, Pantera, Polychain, Framework, and more)

- Traditional VCs: 15+ firms entering DePIN (a16z crypto, Electric Capital, etc.)

- Angels & Operators: 35+ individuals (protocol advisors, former DePIN founders, infrastructure angels)

- Corporate VCs: 6+ strategic investors (Samsung Next, Coinbase Ventures, etc.)

- Ecosystem Funds: Solana Ventures, Protocol Labs, IoTeX Halo Grants, and more

By DePIN Sub-Vertical:

- AI-Infra DePIN (34%): Compute, GPU sharing, AI training infrastructure → io.net, Render, Akash investors

- Utility DePIN (48%): Storage, connectivity, mapping, sensors, energy → Helium, Filecoin, Hivemapper, WeatherXM investors

- RWA-Aligned DePIN (6%): Real-world assets, mobility, IoT → DIMO, Helium IoT investors

- Multi-Vertical (12%): Investors backing multiple DePIN categories

Geographic Coverage:

Investors (VCs, angels, corporate ventures and hedge funds) with activity across North America, Europe, and Asia-Pacific (APAC) based on public footprint and sources provided.

Investment Stages:

- Pre-Seed / Seed: Primary focus for 70% of investors

- Series A: 60% participate

- Growth / Later Stages: 20% participate

(Many investors cover multiple stages)

What “Verified investors” Means (Important)

What we verify:

- Each investor is relevant to DePIN (not generic crypto)

- Valid contact path exists (public Twitter/LinkedIn/email)

- Recent DePIN activity (2024-2025 funding rounds)

- Source URLs provided for validation

What we do NOT guarantee:

- Investor responses or funding outcomes

- Current role accuracy (people change jobs)

- Active deployment of capital right now (market conditions vary)

- Warm introductions or endorsements

Your responsibility:

Double-check key details (especially for top 10 targets) before large outreach campaigns. Use included source URLs to confirm thesis fit.

Is This Good for You?

✅ Perfect for:

- DePIN founders actively fundraising (pre-seed, seed, Series A)

- Projects in AI-Infra, IoT, Storage, Compute, Connectivity, Sensors, Energy, Mapping verticals

- Teams running their own investor outreach (vs. hiring consultants)

- Founders who need contacts this week, not next quarter

- Lean budgets (€149 vs. €5K+ for consultants or data subscriptions)

❌ NOT ideal for:

- Late-stage companies (€10M+ Series B/C—you need investment banks)

- Projects outside DePIN/Web3 infrastructure

- Teams expecting guaranteed warm intros (this is intelligence, not intro service)

- Anyone planning mass spam (use responsibly)

Ready to Start Fundraising Outreach and raise capital in 2026?

150 DePIN investors. Verified contacts. Portfolio proof. Updated December 2025.

You can spend weeks building and cleaning this list yourself.

Or save & start using it instantly after purchase.

What exactly is included in the DePIN Investor Database?

A Google Sheets / Excel-compatible spreadsheet with 150+ verified DePIN-focused investors (funds + angels + select strategic investors). Each row includes investor type, DePIN sub-vertical focus, key decision-maker, direct outreach path (LinkedIn/Twitter/X; email where publicly available), notable bets, and source URLs.

Do you include email addresses?

Yes, some entries include emails where publicly available. Every entry includes at least one direct outreach path (LinkedIn and/or Twitter/X)

How do I get access after purchase?

You get instant access after purchase via the download link provided by Easy Digital Downloads (EDD)

How fresh is the data in investor list and how is it “verified”?

This edition is updated December 2025. “Verified” means we manually checked that the investor is relevant to DePIN and has a reachable contact path, and we include source URLs to help you validate thesis fit.

Is this a list of warm intros or guaranteed fundraising outcomes?

No. This is a research + outreach asset. It does not guarantee replies, introductions, or funding outcomes.

Who is this database best for?

Pre-seed/Seed founders building DePIN (compute/GPU, connectivity, mapping, storage, sensors, energy, mobility, IoT/data networks) who want to run targeted investor outreach without spending weeks on manual research.

Can I share or redistribute the spreadsheet?

The database is intended for internal team/company use only. Please don’t redistribute or republish it.

I’m not building DePIN, should I buy this?

If DePIN investors aren’t your best fit, you’ll likely get better ROI from a broader Web3/AI investor database or a different vertical-specific list. For example, our Database of 200+ web3 angel investors.

What’s the best way to use this database effectively?

Start by filtering to your sub-vertical, shortlist 30–50 best-fit investors, then personalize outreach using notable bets + sources to show real thesis fit.

Save big with InnMind Premium!

Instead of buying documents one by one, upgrade to InnMind Premium Plan and unlock every resource in our library, including all fundraising templates, databases, and future updates, for a single monthly fee, starting from €49/mo.

More value, less hassle, always up-to-date.

Related startup templates you’ll want next: